What happens if you don’t pay RNR tire? It is a common question. There are also many expenses associated with owning a vehicle. Among these expenses is the price for purchasing new tires as they become worn up. There may be major consequences if you don’t pay for the fresh tires immediately. This article will explore what happens if you don’t pay for your tires from RNR Tire Express. We’ll look at the potential ramifications and how to avoid them.

What is RNR Tire?

Customers can choose to pay for tires and other services in instalments at the national tire and wheel retailer RNR Tire. Customers run the danger of incurring late penalties and having their accounts sent to collections if they don’t complete their payments on time. Customers could also be charged court costs if RNR Tire needs to file a lawsuit because they didn’t pay for services.

RNR Tire further retains the right to deny service or end any contract with a client who is late on payments. If payment is not made as stipulated in the contract, customers will also forfeit the promotional advantages connected with tire purchases.

What Happens If You Don’t Pay RNR Tire?

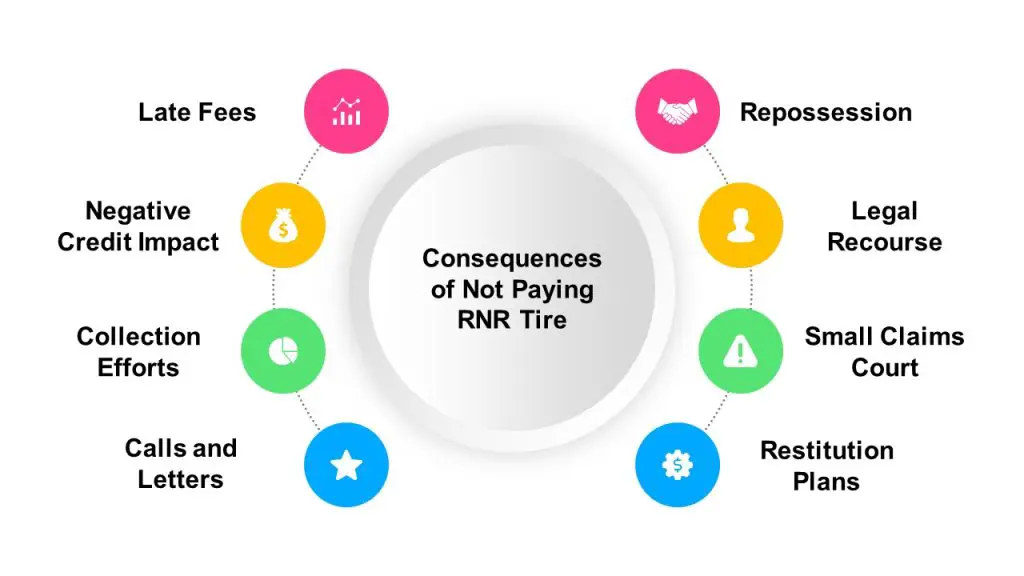

If you don’t pay your bill to RNR Tire, there are several consequences that may follow.

1. Late Fees

Late fees have a significant role in how effectively a company manages its accounts receivable. Businesses frequently utilize late fees as an incentive to encourage quick payment from consumers when they don’t pay their bill or fail to make a payment on it. For instance, RNR Tire will assess a late fee of $10 to $25 depending on the amount outstanding if you don’t pay your account on time. This fee is typically applied the day after the due date for payment and can be compounded if subsequent payments are also delayed.

Late fees can also apply when payments are received but not posted in time by the service provider; this is commonly referred to as “interest” or “finance charges”. Depending on the terms and conditions outlined in your agreement with RNR Tire, these additional charges may be applied if payments are made after certain deadlines or milestones within the contract period.

Read More: Can R and R Tires Send You to Jail?

2. Negative Credit Impact

If you don’t pay RNR Tire, it could have a negative impact on your credit score. This is because the business will alert the credit bureaus about the unpaid obligation that would eventually impact your credit score. Depending upon your payment history and the amount outstanding, this can happen to some or all of it. If RNR Tire takes on you for the unpaid debt, as would be reported to the credit bureaus, this is another element that could have an impact on your credit rating.

In addition to a lower credit score, there could be other financial repercussions for not paying RNR Tire. For example, they may choose to pursue legal action against you or send one of their collection agents after you. They may even make calls or send letters requesting repayment of what’s owed them. Each of these actions will appear on your credit report and could further damage your standing with creditors and lenders.

Lastly, if they get enough evidence that you are unable to pay them back, they could take more drastic measures like putting a lien on any property or assets that are owned by you in order to satisfy their debt from those proceeds instead.

3. Collection Efforts

This is is third consequences of what happens if you don’t pay RNR tire. If an individual does not pay his or her bill to RNR Tire, the company will initiate collection efforts. The methods employed during such attempts can include sending the customer letters of demand or phone calls, reporting the debt to credit bureaus, initiating a complaint with the courts, or engaging in other legal action against the debtor. Collection efforts may continue a few weeks or several months prior to launching legal action, depending on the situation.

For customers to avoid paying additional fees for the collection procedure, they must be aware of their obligations and act quickly. If a customer fails to respond after multiple attempts by RNR Tire’s collections department, they may be forced into court proceedings which could include wage garnishment or seizure of assets if necessary.

4. Calls and Letters

If you don’t pay your RNR Tire bill, the company will start off by sending out multiple reminders to you in the form of calls and letters. These letters could contain notices that if payment is not made, more severe measures might be implemented. The company will take several attempts for getting in contact with you as well, including phone calls, emails, texts, and ordinary mail. When they try getting in touch with you repeatedly but are unsuccessful, they may file a lawsuit against you.

Additionally, they have the power to submit your payments that are late to credit bureaus that may considerably lower your credit rating making it more difficult for you to obtain mortgages or different kinds of money future.

Read More: Why Do Spare Tires Have Higher PSI?

5. Repossession

The lender may decide to reclaim the vehicle if a borrower defaults on their agreed-upon auto loan payments. The repossession is the process through which a creditor seizes property used as security for a loan. The banking company retains the power to seize ownership of the car in the unlikely scenario that a borrower fails to pay the RNR Tire until the loan is entirely repaid.

A notice for default or criminal behavior, which warns the customer that they’re overdue on their payments and need to take immediate action to save their car, is sent out as the first phase in the recovery process. The property may be legally repossessed with additional notification if payment fails to arrive within a month of the granting of this notice. The majority of jurisdictions demand that police officers be present as witnesses during the property seizure procedure.

Consumers may experience extreme financial difficulty when a car is repossessed because of additional costs incurred by lenders, such as storage fees and litigation costs. In some cases, consumers may even have difficulty getting financing in the future due to negative marks on credit reports associated with repossession proceedings.

6. Legal Recourse

When a customer fails to pay their debt to RNR Tire, the company can pursue legal action. This means filing a claim in a civil court and asking that the debtor to be held liable. The court will issue a judgment compelled the creditor to pay the full amount due plus any pertinent interest or fees if it determines the debtor owes funds to RNR Tire. A wage garnish order, which requires a business to withhold some of the debtor’s pay until the debt is paid in full of can be issued by the court.

Additionally, RNR Tire could place a lien on any property owned by the debtor as security for repayment of their debt and seek repossession if necessary. Finally, RNR Tire could report unpaid debts to credit bureaus which would result in negative marks on consumer credit reports and make it difficult for customers who owe money to qualify for loans or other types of financing.

7. Small Claims Court

When a debtor fails to pay, the court for small claims provides a means for debt collection. The creditor may file a small claims lawsuit against the debtor if they don’t pay their bill. Small claims courts are intended to settle financial differences between individuals or companies that are typically under ten thousand dollars. The judge at small claims court is going to hear reasons from both sides before deciding who will win and how much cash ought to be given. The burden of proof rests with the creditor to show what the borrower owed them and why they ought to be compensated to it.

8. Restitution Plans

Restitution plans are created when an individual fails to pay for goods or services. When a person does not pay their bill to RNR Tire, such as for tires, the company may offer a restitution plan as an alternative. A restitution plan is a payment arrangement that allows the customer to make regular payments toward the debt over time until it is paid off completely. The amount of each payment and total number of payments depends on the agreement between RNR Tire and the customer.

RNR Tire may require proof of income from customers before entering into a restitution plan, including recent paystubs or tax returns. The person being sued may also offer reasons for the reason they do not owe the sum or are unable to repay it in full. If the judge determines the creditor has to pay money, they will be given an order against the debtor, allowing them to take what necessary actions to collect what is due, and such banking levy and salary garnishments. If all else fails, lenders may take drastic actions such as seizing assets or putting lien on the assets belonging to the debtor.

Conclusion

In conclusion, not paying RNR Tire for services rendered can have serious consequences. You can be facing legal action or receive a lien put on your property, depending on the amount outstanding and the jurisdiction where you reside. You can be required to cover court expenses and other related fees if you are sued. Your property can continue to be subject to a lien up until the obligation is fully paid. In addition, failing to pay RNR Tire might harm your credit rating and make it harder for you to get additional loans or financing. It is always essential to make sure you pay any payments that are past due as soon as possible to prevent these potential problems.

The Next Road (thenextroad.com) is an affiliate of the Amazon Services LLC Associates Program, so you can access the Amazon marketplace when on this domain. We will earn a commission from your qualified purchases.